Who is the personal representative when there's no will?

Who can apply to be a personal representative if there is no will? Riaz Munir of Gotelee Solicitors LLP explains what the duties of a personal representative are and who decides the appointment of an administrator.

What are the duties of the personal representative?

A personal representative (PR) is responsible for dealing with the estate of someone who has died:

- If the personal representative is named in the will, they are called the executor.

- If there is no will in place, then an administrator is appointed, which is usually a family member or close relative of the deceased.

PRs are appointed in accordance with The Non-Contentious Probate Rules 1987. To act as a PR, they will generally need to obtain legal authority through an application to the court for an order called the grant of representation (‘the grant’). This will always be the case with administrators.

Assuming the PR has not ‘intermeddled’ in the estate (begun administering the estate), they are not under a duty to the estate, its beneficiaries or creditors prior to obtaining the grant. If, however, the PR intends to apply and obtain the grant, then there are obligations and duties placed upon them by legislation.

The duties of a PR can be split into two stages; before obtaining the grant and after the grant has been obtained. Before obtaining a grant, the PR must:

- identify the deceased’s liabilities and assets

- account to HM Revenue and Customs (HMRC) and deal with any inheritance tax

- apply for the grant of representation

After a grant is obtained, the PR must:

- obtain payment of any debts due to the deceased

- gain control of the assets by registering the grant with the asset holder

- convert those assets into money (where appropriate)

Administering an estate requires a PR to:

- maintain the assets safely, once collected

- pay the deceased’s debts

- establish the residuary estate and properly distribute the estate if assets remain

Under s.25 of the Administration of Estates Act 1925, the duties of the PR are to:

- collect and obtain the real and personal estate of the deceased and administer it according to law

- when required to do so by the court, exhibit on oath in the court a full inventory of the estate and when so required render an account of the administration of the estate to the court

- when required to do so by the High Court, deliver up the grant to that court

Who can apply to be a personal representative if there is no will?

If a person dies without making a valid will, they die intestate. Therefore, as no executor is chosen under a will, an ‘administrator’ is appointed to deal with the affairs of the deceased’s estate.

Rule 22 of The Non-Contentious Probate Rules 1987 provides an order of the deceased’s family members who can apply to obtain the grant. This order is reflective of who would be entitled to the estate under the intestacy rules also. The order is as follows

- spouse or civil partner of the deceased

- children of the deceased, which can include adopted children and children born outside of marriage

- parent(s) of the deceased

- the deceased’s brothers or sisters who share the same parents, or if they have died, those siblings’ children

- the deceased’s half-brother or half-sisters, or if they have died, their children

- grandparent(s) of the deceased

- uncle(s)or aunt(s) of the deceased who share the same parents as a parent as the deceased, or if they have died, their children

- uncle(s) or aunt(s) of the deceased who share one parent with a parent of the deceased, or if they have died, their children

If this entire list of family members is exhausted, then the Treasury Solicitor, on behalf of the Crown may claim the estate as being bona vacantia (‘ownerless assets’) and because of the claim, the Treasury Solicitor may apply for the grant.

Additionally, if the deceased owed a debt that has not been paid then a creditor may apply for the grant to recoup the money owed.

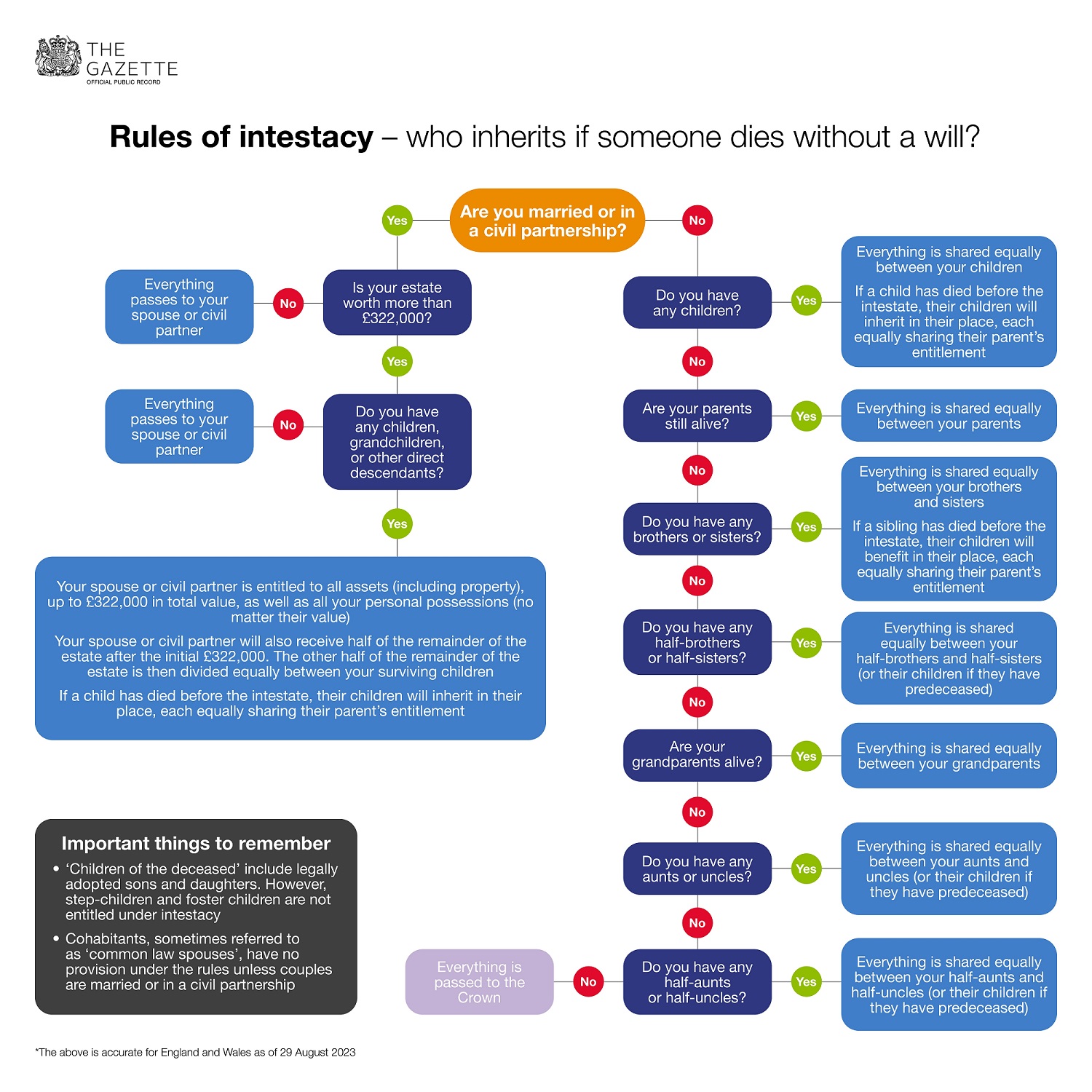

What is the order of intestacy?

The order of entitlement under the intestacy rules is set out under s.46 of the Administration of Estates Act 1925 and depends on two factors; the value of the estate and which family members have survived the deceased. It should be noted that the rules of intestacy are different in Scotland to England and Wales.

In England and Wales, if the deceased dies without leaving any children but is survived by a spouse or civil partner, then they will inherit the entire estate.

If the deceased left behind a surviving spouse and children, then the deceased’s estate would be distributed as follows:

- The surviving spouse takes all the personal chattels and receives a legacy of £322,000 (for all deaths on or after 6 February 2020) and half of the residuary estate.

- The children of the deceased receive the remaining half of the residuary estate. If the children are under the age 18 then it is held on statutory trusts.

If the deceased did not leave a surviving spouse or children, then the order of intestacy would follow the entitlement to the grant as set out above.

Please note for deaths before 1 October 2014 the intestacy rules would apply differently due to new legislation coming into effect.

About the author

Riaz Munir is a Solicitor in the Private Client team at Gotelee Solicitors LLP. With over 5 years’ experience dealing with private client work, Riaz specialises in the preparation of Wills, Lasting Powers of Attorney, registration of Enduring Powers of Attorney and Estate Administration matters.

See also

The duties of an executor: what to do when someone dies

What are the intestacy rules in England and Wales?

What are the intestacy rules in Scotland?

What is a grant of representation and do I need it?

How to pay inheritance tax (IHT)

What happens when joint executors or attorneys disagree with each other?

Find out more

The Non-Contentious Probate Rules 1987 (Legislation)

Administration of Estates Act 1925 (Legislation)

Image: Getty Images

Publication updated: 29 August 2023

Any opinion expressed in this article is that of the author and the author alone, and does not necessarily represent that of The Gazette.