What are the intestacy rules in England and Wales?

What happens to someone’s money, property and possessions when they die without a will? Sharon Crosby of Lodders Solicitors explains and clarifies the rules of intestacy in England and Wales.

What is intestacy?

‘Intestacy’ occurs where a person dies without leaving a valid will and is said to die ‘intestate’, as opposed to ‘testate’.

The intestacy rules in England & Wales also apply where a person leaves a valid will but it does not distribute all their ‘estate’ (money, property and possessions). This can happen for various reasons, for example, where all named beneficiaries have died. This is a ‘partial intestacy’ and can be an unexpected outcome. To avoid this situation, the person making the will, the ‘testator’, should always include substitute ‘beneficiaries’ (the people who benefit from an estate).

What is the order of the beneficiaries according to the rules of intestacy?

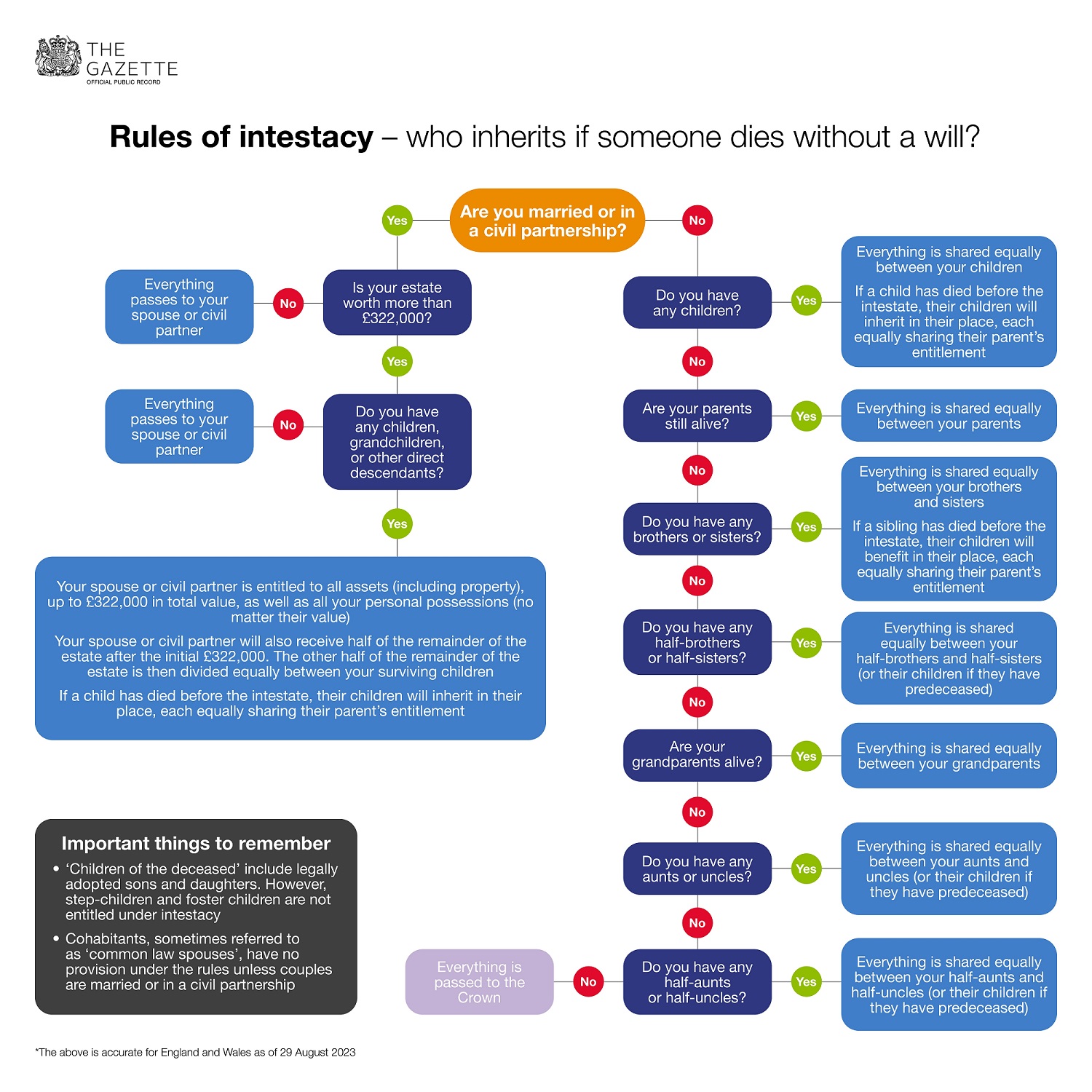

The order of priority on intestacy is set out in Section 46 of the Administration of Estates Act 1925 (AEA 1925), as amended. The rules in relation to a surviving spouse also changed significantly following the Inheritance and Trustees’ Powers Act 2014 (ITPA 2014).

The current intestacy rules state that, initially:

- Where there is a surviving spouse and no children, the spouse is entitled to the entire residuary estate.

- Where there is a surviving spouse and children, the spouse is entitled to the ‘personal chattels’ (movable property, but not money)

of the deceased and a statutory legacy (following the enactment of The Administration of Estates Act 125 (Fixed Net Sum) Order 2020, currently £322,000), including interest from the date of death. The residuary estate,

if any, is then divided equally between the spouse (50%) and the children (50% divided

between however many children there are).

- - Prior to ITPA 2014, 50 per cent of the residue should have been held on a life interest trust for the spouse (rather than an outright entitlement), which was often misunderstood or incorrectly implemented.

There is a ‘survivorship period’ imposed for a spouse (a time in which they cannot inherit) of 28-days. If the spouse dies within that time, they are treated as having not survived the deceased. The next class of beneficiary becomes entitled, for whom there is no survivorship period.

What happens to an intestate estate if there is no spouse?

Where there is no surviving spouse, the following classes of beneficiaries are entitled to the estate. If there is no-one within a class, the persons in the next class become entitled:

- Initially, the children of the deceased receive the estate. This includes legitimate, illegitimate or legitimated children, as well as children adopted by the deceased. A child of the deceased adopted by another person will not be entitled, unless the adoption occurred after the death. This remedies the situation where a child may be adopted by another person following the death of their parent and as a result loses their entitlement to their parent’s estate. Step-children or foster children are not entitled under intestacy. If a child has died before the intestate, their children will inherit in their place, each equally sharing their parent's entitlement.

- If there are no children, the parents of the deceased are entitled in equal shares when both are alive, or solely to the surviving parent. In addition, the Family Law Reform Act 1987, as amended by ITPA 2014, states that where parents were unmarried when the intestate was born and the father (or parent other than the mother) is not named on the birth certificate or any record of birth, there is a presumption that the father, and any person related to the intestate solely through their father, died before the intestate unless the contrary is shown. This means that it may not be necessary to attempt to locate a missing father, or any other relatives on the father’s side, unless there is evidence that they are alive.

- If no parents survive, siblings described as ‘of the whole blood of the deceased’, meaning siblings who share both parents, or their issue, are entitled. If a sibling

has died before the intestate, leaving children of their own, these children will

benefit in their place, sharing their late parent’s entitlement.

- - To illustrate this point: Mary has two brothers, Phil and Josh. Phil has four children and Josh has two children. Both die before Mary who dies intestate, leaving her nieces and nephews as the only persons entitled to her estate. Half of the estate goes to Phil’s four children and half to Josh’s two children. Although they are all related to Mary in the same degree, the share of the estate that they receive depends on their own family tree.

- If no whole blood siblings survive, siblings of ‘half-blood’, meaning with one parent in common with the deceased, or their issue, are entitled. The half-blood siblings may be related to the deceased through their mother or father.

- If there are no siblings of whole or half blood, the grandparents of the deceased receive equal shares of the estate.

- If there are no grandparents, then aunts or uncles of the whole blood, or their issue, will be entitled to an equal share of the estate.

- If there are no aunts or uncles of the whole blood (or their issue), then aunts or uncles of the half blood, or their issue, will be entitled to an equal share of the estate.

- If there are no aunts or uncles of the half blood or their issue, then the Crown, Duchy of Lancashire or Duke of Cornwall, will inherit. The Treasury Solicitor will deal with the estate. The Gazette lists these ‘unclaimed estates’.

It should be noted that an estate is held on statutory trusts for beneficiaries under the age of 18. When they reach 18 (or marry earlier) they become entitled to their share of an estate. If they die before becoming entitled, their share is redistributed among other beneficiaries.

Which relations are excluded in intestacy?

Aside from those mentioned already, a major category of people excluded under intestacy rules is cohabitants, sometimes referred to as ‘common law spouses.’ It is a common misconception that cohabitants have some legal entitlement to an estate. Currently, there is no provision under the rules unless couples are married or in a civil partnership.

However, cohabitants could qualify as dependents for the purposes of a claim for provision under the Inheritance (Provision for Family and Dependents) 1975 (IPFDA). Regardless of whether the deceased died with a will or intestate, the claimant must demonstrate that the distribution of the estate does not make adequate financial provision for them. The class of persons entitled to make a claim under IPFDA extends beyond the limits of those entitled under intestacy. It includes:

- former spouses

- civil partners

- children treated as a child of the family, such as step-children

The Cohabitation Rights Bill 2017-19, which has been presented to the House of Lords, could also affect unmarried couples living together in the future.

It should also be noted that, as with a beneficiary under a will, a beneficiary responsible for the death of the intestate is not able to benefit from an estate under the rules of intestacy. The Estates of Deceased Persons (Forfeiture Rule and Law of Succession) Act 2011 also clarified the position in this situation whereby the issue of the guilty party could benefit in place of their parent.

Can a beneficiary disclaim their inheritance?

A beneficiary can ‘disclaim’ their inheritance under intestacy rules. Prior to 1 February 2012, this sometimes led to unexpected outcomes as the children of a beneficiary would only benefit from an estate if that beneficiary had died before the deceased. If a beneficiary gave up their entitlement after the death, then their own children would not benefit in their place.

For example: Mary has two brothers, Phil and Josh. Mary dies with Phil and Josh surviving her. Josh gives up his inheritance, thinking that his share will instead pass to his two children. However, as he did not die before Mary, his share cannot pass to his own children, and in fact goes to his brother Phil.

However, this was remedied by the 2011 Act which states that where a person disclaims their entitlement they are treated as though they died before the intestate. In our example, Josh’s share will now pass to his own children.

How do I find beneficiaries in intestacy?

It is important to locate all potential beneficiaries of an estate. Dealing with an intestate estate often involves research to trace the potential beneficiaries and in turn, prove the entitlement of those beneficiaries to a share of the estate. This can be done using birth, marriage and death certificates. In some situations, the deceased may not have known the people who ultimately inherit the estate.

Tracing can lead to delays in dealing with and concluding matters and the costs involved can significantly diminish an estate. Genealogy companies are often required to carry out the research, and with support from a solicitor, notices are usually placed in publications including The Gazette.

Those entitled to benefit from the intestate estate are also the people eligible to act as personal representatives (PRs) and trustees by taking out the grant of probate and administering the estate. In relation to this:

- Where there are minor beneficiaries entitled to an estate, two PRs are required, and the grant may need to be taken out for the use and benefit of the minors. There is a further order of priority about who can act for the minor and it is usually someone with parental responsibility. This may be an issue if the person who has died is the parent of the minor. You can appoint other individuals to act on behalf of minors, but this requires an application to the probate court.

- If all beneficiaries are adults, one person can take the grant on their own. Of course, there may be multiple persons entitled in the same degree. This can lead to a race for the grant where the beneficiaries cannot reach an agreement about who should apply.

How is an intestate estate distributed?

The distribution of an intestate estate can be rearranged in the same way as a testate estate by a ‘deed of family arrangement.’ All affected beneficiaries must agree to any amendments and must have capacity to do so.

You cannot change the entitlement of a child or mentally incapable adult without a court order, and you would need to show that the changes were in the best interests of the vulnerable individuals concerned. It is therefore recommended that the deed of family arrangement specifically directs and records any redistribution of an estate.

About the author

Sharon Crosby is a solicitor in the Private Client department of Lodders Solicitors, where she specialises in wills and probate matters and estate administration.

See also

Place a deceased estates notice

Find unclaimed estates in The Gazette

Find out more

Administration of Estates Act 1925 (Legislation)

Inheritance and Trustees’ Powers Act 2014 (Legislation)

The Administration of Estates Act 125 (Fixed Net Sum) Order 2020 (Legislation)

Family Law Reform Act 1987 (Legislation)

Inheritance (Provision for Family and Dependents) 1975 (Legislation)

Cohabitation Rights Bill [HL] 2017-19 (Parliament.uk)

Estates of Deceased Persons (Forfeiture Rule and Law of Succession) Act 2011 (Legislation)

Images

Getty Images

Publication updated

13 February 2025