British businesses must admit when they are having problems

The negative stigma attached to business failure, or the threat of it, must change,

says ICAEW.

The negative stigma attached to business failure, or the threat of it, must change,

says ICAEW.

Businesses face many hurdles in their lifespan, some of which can threaten their very viability, placing potentially intolerable pressure on their finances.

When this happens, it’s critical that owners and managers adopt a vigilant approach towards accounting and, critically, that they recognise when financial trouble starts and take immediate action to avoid an otherwise inevitable trajectory towards insolvency.

The negative stigma attached to business failure, or the impending threat of it, must change. Having adopted the British approach of pretending that everything is just fine when all around is failing, many businesses have fallen into avoidable insolvency.

Bob Pinder, ICAEW’s insolvency director, says: “We believe that a change in attitudes is critical in order to successfully avoid substantially increased corporate insolvencies – confronting business issues, rather than being ashamed of them. Seeking the early help of restructuring and insolvency practitioners enables a review of business processes or management to salvage many businesses, bringing them back into profit.”

Tax liabilities such as NI, PAYE and VAT repayments, can be a key element in losing control of a company's finances. Often seen as a non-critical supplier, as opposed to the purchase of raw materials, legal or wage bills, HMRC can sometimes end up being a large stakeholder in failing businesses with numerous debts to recoup. But by gaining timely advice from tax practitioners in the early stages, many businesses could avoid reaching insolvency prospects.

What to look out for

Tyrone Courtman, ICAEW licensed IP and turnaround specialist from PKF Cooper Parry, highlights the critical early warning signs and suggests what actions must be taken:

“Many businesses seek the willing assistance of HMRC to secure a time to pay arrangement – staggering payments and enabling owner/managers to regain control of their finances. Demonstrating that the cash-flow crisis was a one-off, caused by extenuating circumstances such as legal challenges, is sufficient for many to gain such terms from HMRC. Too many businesses, however, see this as an easy way to keep working capital in the business and only deal with the symptom, not the cause. Defaulting on time to pay installments bears a costly consequence."

When a business struggles to pay HMRC by the due date, the alarm bells should begin ringing. They must ask themselves why it is they can’t pay, and objectively review their liquidity issues. Is it just the legal bills that they are facing, or is the problem more endemic? It’s critical to establish if these are short-term cash flow issues, or more substantial problems at the route of the company’s accounts. This will help to establish what nature the refinancing can or should be.

If the company is loss-making, they must look at improving the bottom line – possibly through an increase in sales volumes or prices, or by reducing costs or manpower within the business. In practice, it is not uncommon to see a business shrink as a foundation to any turnaround plan, enabling it to free up much needed working capital, while at the same time refocusing on customers and activities that are profitable.

The insolvency process

If all efforts have been made to bring the business out of its decline without success, then it is time to resort to insolvency procedures.

PKF Cooper Parry’s Tyrone Courtman explains further: “The optimum solution is often that the business owners are able to retain control over their company. There are a number of options available, but not all enable that common aspiration to be achieved. Options such as an accelerated merger and acquisition process, or going into trading administration, disposing of assets and the business as a going concern, may provide an acceptable result for creditors, but in these cases, it will mark the end of the business for the owners.”

One of the more flexible arrangements is a company voluntary arrangement (CVA). These arrangements enable owners to retain day-to-day control while returning a more beneficial return to creditors, albeit over time. To secure this, there are a number of key ingredients that must be in place:

- The proposed arrangement must demonstrate that the company’s restructure under a CVA would deliver a better result for creditors.

- They must achieve the buy-in of investors and the owner/manager(s) to be entirely open to administering the necessary changes to restore profitability.

- The support of 75 per cent by value of the company’s unsecured creditors must be secured, in many cases the most influential of which is HMRC.

The licensed IP can then become the conduit with HMRC in the formal role of supervisor, acting as a go-between with the company and its creditors. Critically though, this option is really only open to businesses that face up to their problems early – if left too late, it is most likely that an administration of voluntary liquidation will be the only remaining option available.

Actions to be taken

IPs questioned in the ICAEW survey felt that the top three reasons for not seeking help were:

- worry about loss of control in the final outcome (57 per cent)

- lack of knowledge of options (52 per cent)

- fear of impact on family and lifestyle (41 per cent)

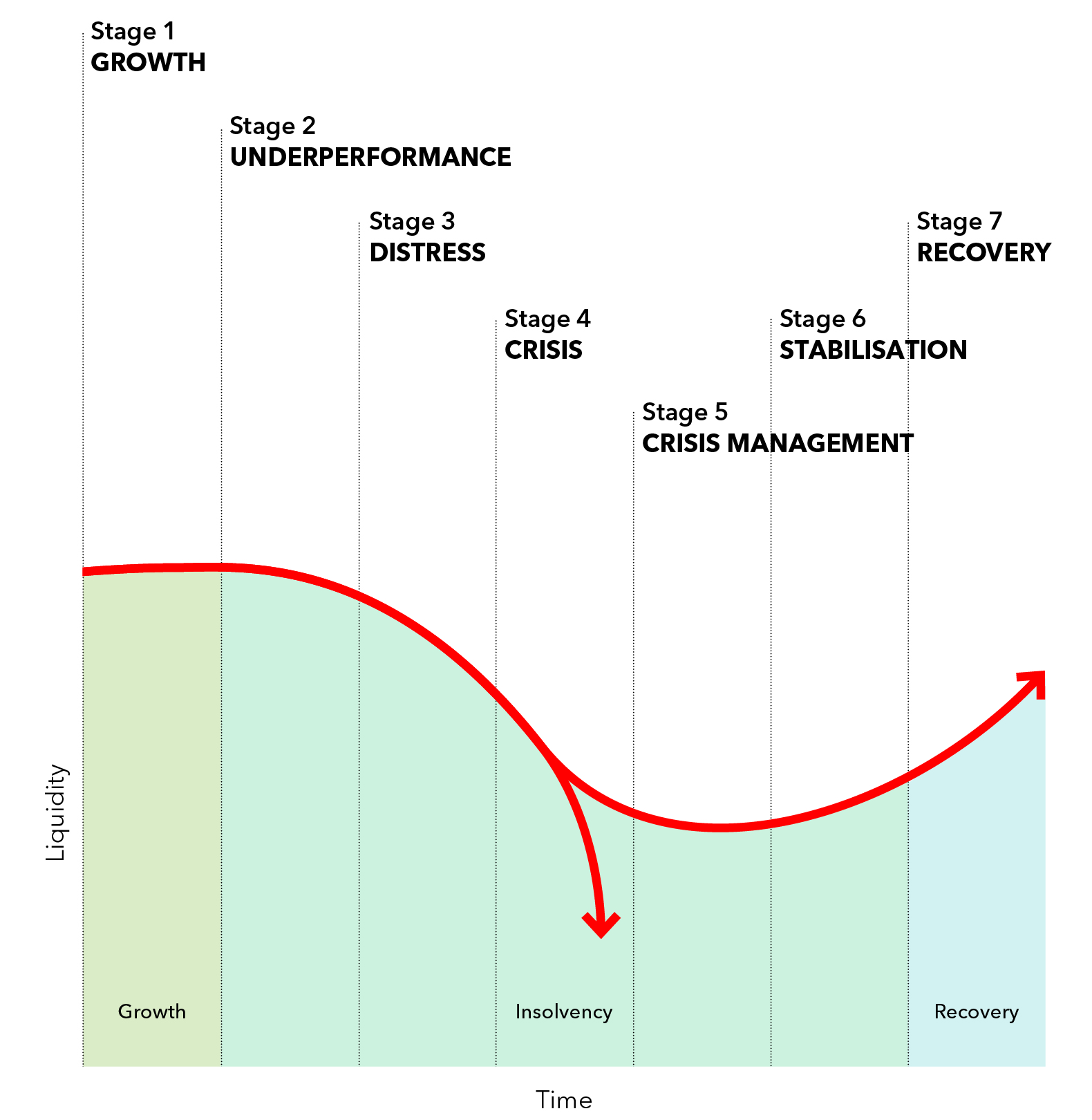

Bob Pinder comments: “The greatest help advisers can provide to a business that has entered the decline curve is to help them take an objective look at what state their business is in. Ensure that they look out for early signs of problems, such as lower than expected bank balances, defaulting on bills or falling profit margins. As soon as the ‘zone of insolvency’ is entered, they must seek help. The difference between businesses that survive and thrive and those that fail is how well they manage such difficulties. If they do this well, it is possible to move away from insolvency, towards crisis management, stabilisation and, finally, into recovery.”

Below: the seven stages of business recovery

Resources for IPs, and where to find an ICAEW licensed IP, can be found here.

About the author

ICAEW is a professional membership organisation that provides insight and leadership to the global accountancy and finance profession.