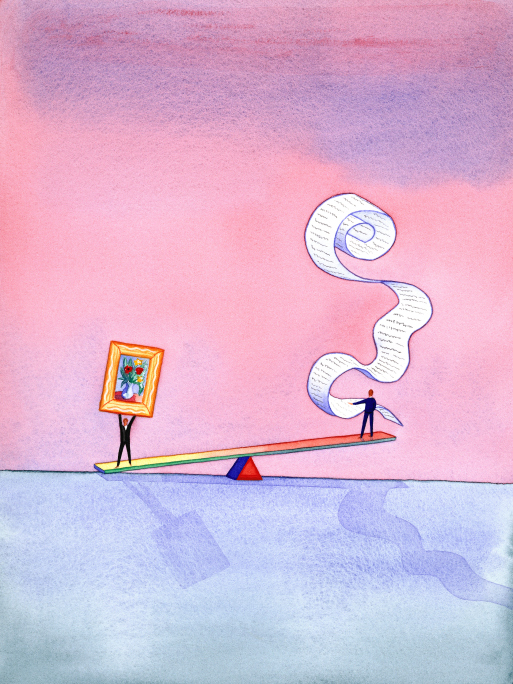

Restructuring and turnaround: balance and sacrifice

Colin McIntosh, partner, provides an overview of restructuring and turnaround and the balance (and sacrifice) required for a business to recover.

Does the term ‘restructuring’ fill you with fear and dread? Or does it fill you with

optimism for the potential to make a fundamentally good business that’s over-burdened

with debt viable again, thereby preserving employment and ongoing trade?

Does the term ‘restructuring’ fill you with fear and dread? Or does it fill you with

optimism for the potential to make a fundamentally good business that’s over-burdened

with debt viable again, thereby preserving employment and ongoing trade?

Equally, the term ‘turnaround’ can mean the unwelcome intervention of third parties who do not understand the nuances of your particular business taking control and charging handsomely for the privilege. But it can also provide an opportunity to obtain practical advice and input from experienced professionals who have already guided numerous businesses through the difficulties that financial distress presents.

Restructuring and turnaround have certain basic principles and characteristics that are common to both.

Restructuring

This can take many different forms, including:

- Financial restructuring: reorganising the amount of debt, its structure, its repayment profile, and its cost, all in order to ensure that the restructured business has the necessary facilities to meet ongoing trading requirements.

- Equity restructuring: capital raising through share subscriptions, potential private equity investment, debt to equity swaps, and alterations to fixed dividend entitlement, to ensure a solid balance sheet, and fill any voids in debt finance packages.

- Business model restructuring: changing the business itself, investing in more profitable elements, reducing or eliminating loss-making elements, changing location, altering working patterns or employment structures, and re-evaluating the traditional customer base or service offering; all to make the business reflect changes in the market place and return to better profitability.

References to restructuring can now include those in a formal insolvency process. In this context, a formal insolvency process can be engaged to achieve some or all of the foregoing elements – whether to save the pre-existing corporate entity or, perhaps more frequently, in an attempt to focus on preserving the underlying business.

Turnaround

This is normally associated with the financial, equity and business model restructuring examples listed above, and with saving the corporate vehicle by returning it to viability. It is sometimes difficult to reconcile the use of the term turnaround in circumstances where a formal insolvency process is used – unless, of course, it is in a group scenario, where the pruning of withering branches from a tree can result in it bearing fruit in future seasons.

Paying the price

Whether we talk about a ‘solvent’ restructuring, or one implemented through the use of a formal insolvency regime, a price may have to be paid by certain parties in order to save the corporate and/or its business.

Debt providers may require to accept the oft referred to ‘haircut’, the remodelling of employment structures may lead to certain employees (including senior management) feeling that they are paying an unfair price, and investor value may, in many cases, be entirely lost.

Who pays the highest price is determined by the facts and circumstances of each individual case. There are great potential benefits to be gained through early intervention and the proper and proportionate use of restructuring and turnaround mechanisms, but a price may have to be paid. In the words of author Simon Sinek, “There is no decision that we can make that doesn’t come with some sort of balance or sacrifice.”

About the author

Colin McIntosh is a partner, and leads the corporate restructuring and insolvency group, at Brodies LLP. Follow @BrodiesLLP or visit the website for more information.